We provide easy and fast access to the working capital that your business needs. If you need a cash advance, Maverick will give you the money you need now and create a plan to have a future percentage of your sales act as repayment. Repayment term ranges can range from anywhere from 4 to 12 months. Our repayment structure is contingent on how your specific business collects revenue from customers.

If the majority of your revenue comes via credit card transactions – our Maverick Merchant Cash Advance is perfect for you. If your money is collected through bank deposits and invoices then our Maverick Business Cash Advance program is the right product for you.

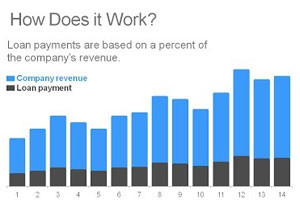

How Revenue Based Financing Works

Existing Revenue

To qualify you need an existing revenue stream of at least $15,000 in revenue per month for 3 months.

Growing Your Business

Be growing, not burning a ton of cash, and have a clear path to profitability with a good plan for use of funds

Revenue Based Loan

Loses no equity or control to the lender. Fixed interest rate. Daily direct debit based on percent of gross revenue.

One of our sales revenue funding specialists will work with you to create the best loan for your business. Funds are deposited to your account within 72 hours or less. Our loan specialists are readily accessible and available , so you can always find help when you need it.

We are committed to your businesses future. Maverick offers lower initial rates and are willing to offer you more capital as needed.

Maverick is a direct funder and not a bank, and we offer merchant cash advances, not small business loans. We give funding to small businesses in any industry, provided that the business has been operating for at least 3 months and has gross monthly sales of at least $15,000.

Sales Revenue Funding

Sales Revenue Funding What’s a Business Cash Advance?

What’s a Business Cash Advance? Advance Calculator

Advance Calculator Maverick VS Your Bank

Maverick VS Your Bank Unsecured Funding

Unsecured Funding