HOW IT WORKS

What is Revenue Based Financing?

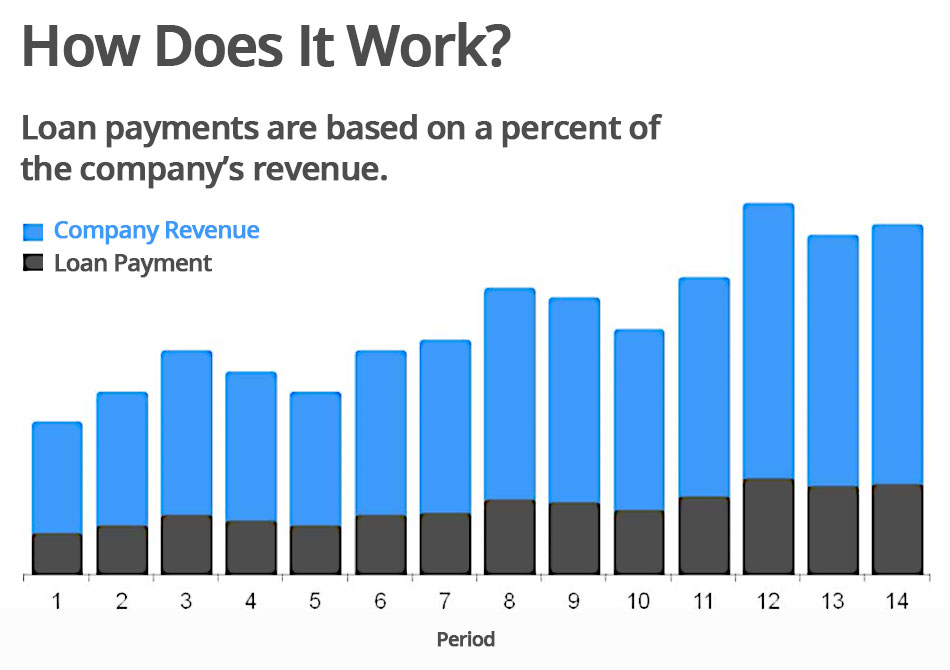

Unlike traditional loans, revenue based financing doesn’t require any collateral to secure. As a direct lender Maverick Capital Funding will assess your business finances and your projected business growth in order to determine your eligibility and approval amount for funding. The money is then repaid based on your monthly business finances, with a pre-determined percentage deducted each month from your account. Revenue based funding is a long-term solution without specific term limits, and repayment is entirely determined by your business’ finances.

While revenue based funding provides a viable alternative to traditional lending, it isn’t for everyone. According to Bloomberg, for businesses with low profit margins, revenue based financing isn’t ideal, as the fixed monthly percentage will further impede on your finances. Additionally, given revenue based financing relies on a fixed monthly percentage, businesses can end up paying a lot for the loan over time.

ALTERNATIVES

Is Merchant Funding More Your Style?

For those seeking a payment style more similar to revenue based financing, Maverick also offers merchant cash advances. This is similar to a revenue based loan, however merchant cash advances are repaid based soley on a negotiated percentage of business profits. Converesely, they differ from traditional revenue based funding in that they are easier to qualify for and come with short-term repayment plans.

Sales Revenue Funding

Sales Revenue Funding What’s a Business Cash Advance?

What’s a Business Cash Advance? Advance Calculator

Advance Calculator Maverick VS Your Bank

Maverick VS Your Bank Unsecured Funding

Unsecured Funding